Advantages of a limited company.

1. Limited Liability to owners.

The term “Limited liability” refers to the extent to which the owners are personally “liable” for the debts of the business in the event that the company runs out of money.

This personal liability is limited to the value of the shares the owners agree to purchase when the company was first set up – the share capital of the company.

The owners of unincorporated businesses such as sole traders and partnerships are personally liable for all of the debts of their business in the event the business runs out of cash.

2. Low set up costs.

The UK has the lowest company formation costs in the world.

There are no complex rules or requirements for becoming a company director (who are responsible for running the company’s affairs) or setting up a limited company. Anyone can have a go.

It’s a bit like selling pilot’s licences for £10 and .This probably accounts for why 80% of new companies “crash and burn”

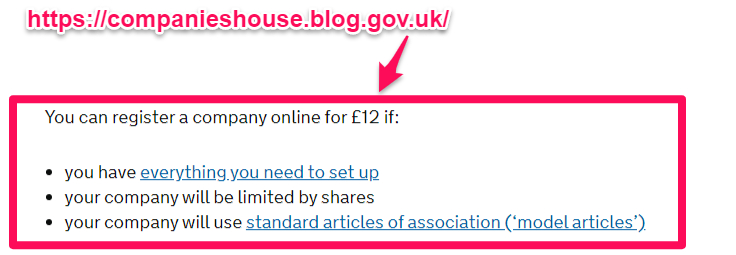

3. Easy to register and set up

The UK companies regulatory framework is good making it really straightforward to set up a limited company. The Companies Act was comprehensively reviewed and updated in 1985 and 2006 and unlike a lot of Government law making, it wasn’t rushed and plenty of consideration was given to detailed consultation processes.

To register a company you need to deliver a comprehensive rulebook or constitution detailing how the company is run.

UK companies can use a ready-made rulebook (Articles of association) when setting up their businsess

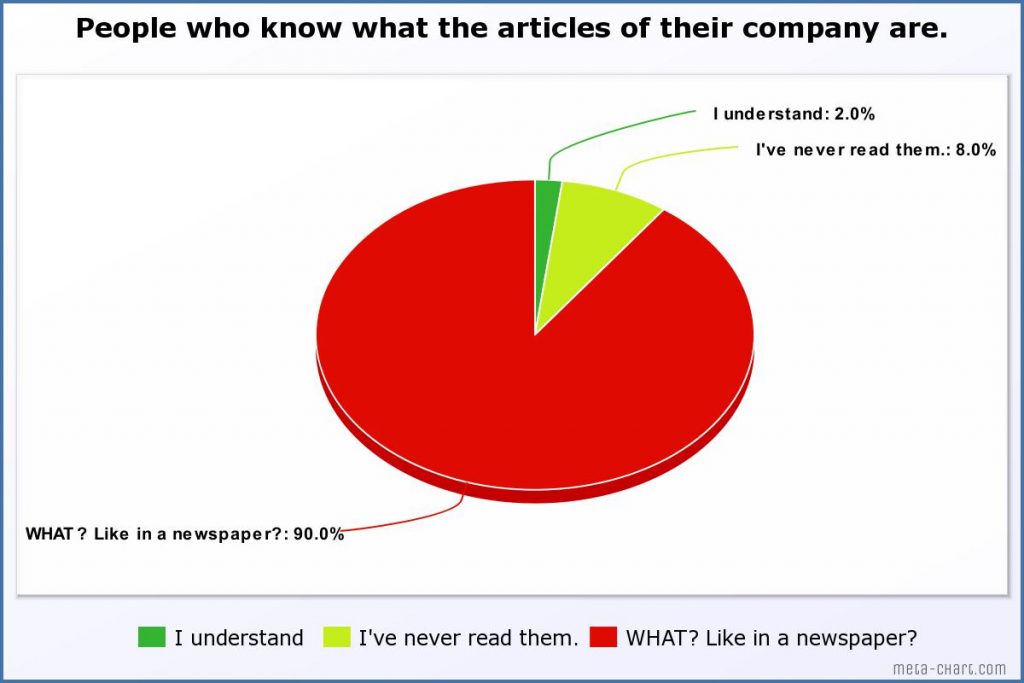

These are known as the “Articles of Association” of the company, or “articles”;

The articles cover things like how directors are appointed and removed, who decides how much directors are paid, who decides how much the dividend distribution to the shareholders are and how frequently they are made, how often meetings of directors and shareholders should take place, who can vote at meetings and on what type of decisions. How many eligible shareholders must be present for votes at meetings to be valid, whether or not postal or proxy votes voting is allowed and so on (and on and on).

Fortunately there is an off-the-shelf set of “model articles” in the 2006 Companies Act. Nearly all new Companies now use the model articles.

90% of new company owners won’t even know the articles exists, 98% will not have read them and 100% will never give them another thought unless they are asked for a copy by their bank.

Put yourself in the top 2% of new director’s by reading their articles once – a skim through will do and along with some of my other articles will give you a much better understanding of how limited companies work and should be run.

4 Simple succession and business transfer.

Succession means transferring or handing on the business when the current management and owners exit the business.

This usually happens in 2 scenarios. When you decide you’ve had enough and sell the business on, or it can be unplanned event such as the incapacity or death of the current owner.

This is MUCH easier with a Limited company than with an unincorporated business such as a sole trader.

As the company exists as a separate legal entity to the owners, it will own any assets or property in the company name. This includes physical property like buildings, vehicles and equipment and also things like the cash in the business bank account and the rights under any contracts the company has entered into (both purchase and supply contracts). The only thing the company doesn’t own are the issued shares in the business which are owned by the shareholders.

To transfer the ownership of ALL of this property, cash in the bank and contractual rights and obligations in the company name the shares in the business are transferred to another person or people. You could do this because you have sold the shares in your company or because you have left the shares in your will in the event of your death. Everything is transferred in one transaction.

An unincorporated business like a sole trader cannot do this. Buildings need to be transferred and “title” changed to the new owners, vehicles have to be re-registered, bank accounts need to be closed and opened in the name of the new owner. Customers and suppliers need to be told on an individual basis that the business has been sold and, where everyone agrees, new contracts of purchase or supply entered into.

5. Tax advantages.

Unincorporated businesses (sole traders/partnerships) pay personal income tax on their profits, or their share of the profits in the case of partnerships.

Income Tax rates and bands (for sole traders and partners)

| Band | Taxable income | Tax rate | |

| Personal Allowance | Up to £12,500 | 0% | |

| Basic rate | £12,501 to £50,000 | 20% | |

| Higher rate | £50,001 to £150,000 | 40% | |

| Additional rate | over £150,000 | 45% |

Tax for incorporated businesses is much lower. Limited Companies pay corporation tax at a rate of 19% (2023).

Profits are usually extracted from a company using a mixture of salary and dividends.

6. Retained profits.

This is a massive advantage of a limited company over a sole trader and is completely legal. I add the “completely legal” bit as when customers grasp this concept they are usually so stunned by how beneficial Limited Companies can be they have an instinctive feeling that it must somehow be “wrong”.

A sole trader MUST pay tax on all the profits they make in any particular tax year. Therefore if you are lucky enough to get a “one off” big contract, let’s say you make £100000 profit, after your personal allowance you would pay basic rate 20% tax on the next £37500 of profits and you must pay tax on next £50000 at the higher rate of 40%.

A limited company would only pay tax at 19% on the entire amount. Importantly it is completely legal to “retain” the profits in the company. This means out of the £81,000 your company would have in the bank (£100000 less Corporation Tax of £19,000) you can pay yourself a mix of salary and dividends of up to £50000 so that no part of your personal income attracts tax at the unfavourable 40% tax rate. This would still leave £31000 in your company bank account which is in effect yours and can extracted in a later tax year or put to another use. The retained profits are even called “shareholder funds” in the company accounts.

A further benefit of retaining profits in the company is that it will improve the Company’s credit worthiness.

7. Name protection

Registering your company provides a level of protection for your business name.

There are strict rules for choosing a company name. When initially picking a name you should not choose a name which is too similar to an existing company name on the register of companies at Companies House. If you do the existing Company might object to your chosen name and you will have to change your company name or appeal to the company names tribunal where there is a risk you lose your appeal and are required to pay costs and still have to change your company name.

The reverse of course applies. If you discover another more recently registered company has a name that is too similar to your own, you may register an objection with Companies House who may agree and issue an order that the other company changes their name.

8. Flexible ownership structure

In a similar way that “succession” is more straightforward in a limited company compared to a sole trader, it is also simple to change the ownership of a company.

In a company the shareholders own the business. If you want to increase the number of participants (owners) in a business, you simply issue more shares in the company or transfer some of your shares to the new participant.

If someone no longer wishes to participate in the ownership of the business the co-owner(s) can elect to buy the exiting party’s shareholding from them.

Disadvantages of a limited company.

1. Complex administration

Compared to running a business as a sole trader the administrative affairs of a Limited company are more involved.

As a sole trader business your only obligation is to produce a set of sole trader accounts and file a tax return each year paying any tax due.

Notifying Companies House of any changes to your company as they occur;

Filing an “Confirmation Statement” at least annually with Companies House (fee applies);

Filing annual accounts with Companies House – even if the company is non-trading or dormant;

Filing accounts with HMRC and attaching a Corporation Tax computation annually;

Fortunately these processes can be outsourced in one way or another, in many cases being handled by the company’s accountant. However there will be a cost for this administrative support.

2. Obtaining Finance

As a Limited Company provides liability protection for the company’s debts to it’s owners, the risk of non-payment shifts entirely to the companies suppliers (creditors).

Many companies will not offer a Limited Company a credit facility without any “track record”.

A good “track record” is obtained by filing favourable accounts at Companies House showing healthy profits and ideally retained profits.

Banks will usually get round this by requiring a “personal guarantee” – (also called a “PG”) from the directors/owners. If the company is unable to repay the bank on a loan, the bank will activate the PG and get you to pay the outstanding liability.

[: You should always avoid entering into any PG arrangements and try to maintain your “Limited Liability” benefit.]

3. Public record of your finances and filing history

UK company framework promotes “transparency” at all levels. This is why the register of people with significant control was introduced for instance.

Transparency extends to the public availability of your company’s accounts.

Anyone can download a copy of your company’s accounts for free from the Government. They can also see if you ever forgot to file anything, whether you’ve had a company that went into liquidation or was “struck off” the register of Companies.

Unincorporated businesses do not have a public database of their finances and all accounts are filed confidentially with HMRC.

15 comments on “8 Advantages and 3 Disadvantages of a Limited Company”

There is no apostrophe in PLC’s!!! It’s just PLCs because it isn’t a possessive.

😉

Now fixed. Thanks for pointing it out.

the information was very helpfull,but i need to know more. Is there a person i can get in touch with

Hi Frank,

You can call in on our main number, 0800 0828 727, and speak to one of our business consultants. Alternatively if you can use the contact form on our website https://www.thecompanywarehouse.co.uk/contact-us one of them will get in touch with you.

Thanks

There is a spelling mistake in the Restricted Capital Raising section. It says thi. It should be this.

I don’t mean to be mean, but it doesn’t look professional when there are spelling mistakes.

I have fixed it, thanks for letting us know.

Last paragraph before Related Reading shoul read if you are looking. Sorry,.

Thanks John, now fixed.

Hello,

As a current business man with 10 years experence, I found your site very useful. The advice is some what good. But if you really are considering setting up please talk to everyone you can. A buiness advisor, the company warehouse may be your man! The bank, an accountant and as many people who will give free advice as possible. Reserch the market and good luck but a word of warning if you are not prepared to work hard weekends and all hours get a job at mc dounolds plz its much easier. If it was that easy everybody would be rich would they not? But good luck, go get em and I hope you make more money then me ! Dave x

I think the biggest advantage of limited company is the fact that there is limited liability for the shareholders.

One great thing owning a Limited Company is that the financial security because the Company’s shareholders will only be liable for any debt the company also Limited Companies are only taxed on their profits and as such are not subject to the higher tax rates.

Hotel Gault / Karine’s post ist nonsense – it makes no sense and I hope she isn’t a company director.

There are lots of responsibilities and potential liability places upon directors; they need to show a some skill and care in perfoming their duties. The truth of the matter is, very few directors understand their responsibilities and leave themselves wide open to being hekd liable for company dets because of negleigence..

For example, there have been cases where it has been shown companies have technically been insolvent when ordering goods and services; although unlikely to fall fowl on insolvency rules, it can still be demonstrated directors ordered goods and services without any reasonable prospect of paying for them and being held luable to damages under common law.

Mike i totally agree with you!

all the facts .thanks alot

thax for the information it rily helps me a lot