Get my Team to Register Your CIC

- One -Fully Online Service, we can cover the whole UK

- Two - We draft everything for you!

- Three - Free Initial Consultation

Book A Call

How to register a CIC? Read our step-by-step guide to learn the basics and master the registration process.

What’s in the guide?

- What is a CIC?

- What are the key characteristics of a CIC?

- Step by step process to register a CIC

- Decide on a structure for your CIC

- Choose the right articles of association

- How to draft the Community Interest Statement for a CIC

- How to Draft the objects clause for a CIC

- How to draft the asset lock for a CIC

- Where to get help to register a CIC

What is a Community Interest Company or CIC?

A Community Interest Company (CIC) is a specific type of legal structure for a business in the United Kingdom that is designed to benefit the community or pursue social objectives. It is a hybrid entity that combines elements of a traditional company with the aim of providing social benefits to a specific community or the public at large, rather than maximising profits for shareholders.

The primary purpose of a CIC is to carry out activities that have a positive impact on society, such as addressing social or environmental issues, supporting community development, or providing services to disadvantaged groups. This structure allows businesses to operate commercially while prioritising social objectives and maintaining accountability to the community they serve.

What are the key characteristics of a Community Interest Company?

- Asset Lock: CICs have a legal requirement to lock their assets for community benefit. This means that any assets or profits generated by the company must be used for the benefit of the community and cannot be distributed to shareholders as dividends.

- Community Interest Statement: CICs are required to submit a Community Interest Statement during their registration, outlining their specific social objectives and how they plan to benefit the community or society.

- Community Interest Test: CICs must pass a Community Interest Test during the registration process to demonstrate that their activities are in the best interests of the community or the public.

- Regulated by Companies House: CICs are regulated by Companies House, similar to other types of companies in the UK, and must adhere to reporting and filing requirements.

Overall, the Community Interest Company structure provides a legal framework that allows businesses to operate with a social mission and make a positive impact in their communities, while still functioning as commercially viable entities. This includes the limited right to pay dividends if the CIC is structured as a “limited by shares” company.

Step by step process to register a CIC:

In summary you will need to complete the following tasks:

- Choose the right Articles of Association for your CIC;

- Draft the objects clause for your CIC;

- Write your community interest statement;

- Specify and draft your asset lock;

- Complete and sign form CIC36;

- Have a method to pay the Government fee £65 if applying online.

All CIC’s are registered at Companies House, the UK Registrar of Companies.

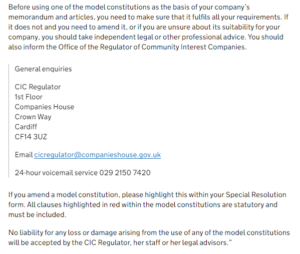

There is a separate Department, The Office of the CIC Regulator, that specifically handles applications to set up a community interest company.

Decide on a structure for your CIC:

The legislation permits several forms of CIC companies. You will need to select the right type of CIC for your social business.

The options are either:

- Limited by Guarantee (small or large membership) or Limited by Shares (small or large membership); and

- In the case of Companies Limited by shares, they can be set up as either “schedule 2” or “schedule 3”

If you are unfamiliar with the different types of limited company see our limited companies guide.

So what do the options mean in practice?

Let’s unpick the differences between differing types of CIC.

Generally, you’ll want to check with potential partners, such as organisations you are approaching for funding, whether they have rules regarding permissible CIC structures for their funding criteria.

What’s the difference between a CIC with small vs large membership?

In all cases a small membership company is one where the Directors are all members, or shareholders of the company (and for clarity all the members or shareholders are directors of the company).

A large membership company is where it has more members/shareholders than Directors.

What’s the difference between a CIC Limited by guarantee vs limited by shares?

A CIC company limited by guarantee does not have shares/shareholders and cannot pay dividends to any individual or body.

A CIC company limited by shares does have shareholders and can pay dividends to any individual or body.

What’s the difference between a Schedule 2 CIC vs schedule 3 CIC?

If the CIC is set up as a schedule 2 company limited by shares it is only permitted to pay dividends to specified asset locked bodies, or other asset locked bodies (with the consent of the Regulator)

If a CIC is set up as a schedule 3 company limited by shares it is permitted to pay dividends to shareholders who are not asset locked bodies, including private investors, but the payment of a dividend to a private financial investor is subject to a dividend cap.

Choose the right articles of association for your CIC

The Articles of association will need to be drafted. Companies House refer to these as the “constitution” of your CIC. In essence the constitution or articles are the same thing and the registrar provide “model” documents for each type of CIC that can be registered.

Please note the disclaimer on Companies House site regarding the suitability of these documents for your CIC.

Whichever model document you choose, you must amend with the following information:

- The CIC name you are registering;

- The Asset lock;

- The Objects Clause of the CIC.

How to draft the Community Interest Statement for a CIC

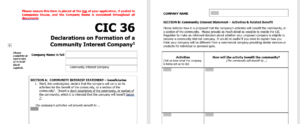

Where is this? The Community Interest Statement is notified on Form CIC36.

The Community Interest Test is a key requirement that Community Interest Companies (CICs) must meet during the registration process in the United Kingdom. The test is conducted by the Regulator of Community Interest Companies.

The purpose of the Community Interest Test is to ensure that the activities and operations of a proposed CIC are indeed for the benefit of the community or the public at large. It verifies that the CIC’s primary objectives align with social or community-based goals rather than solely pursuing private profit.

During the Community Interest Test, the Regulator considers various factors, including:

- The company’s stated community or social objectives: The CIC must demonstrate that its primary purpose is to provide a benefit to the community or society as a whole, rather than solely focusing on financial gain.

- The proposed activities of the CIC: The Regulator assesses whether the activities the CIC intends to undertake are likely to deliver a positive impact on the community or achieve the stated social objectives.

- The intended beneficiaries: The CIC needs to identify the specific community or target group it aims to benefit and how it plans to do so.

- The arrangements for asset distribution: The Regulator examines how the CIC plans to utilise its assets and profits, ensuring that they are directed toward community benefit and not for the financial gain of individuals or shareholders.

By passing the Community Interest Test, the CIC demonstrates its commitment to serving the community’s interests and qualifies for registration as a Community Interest Company. It helps maintain the integrity of the CIC structure and ensures that CICs operate with the intended purpose of benefiting society.

The Regulator of Community Interest Companies determines whether the Community interest test has been met from the information contained in the articles and in the supplementary form CIC36 which includes your community interest statement.

The Community Interest Statement should be concise, yet comprehensive, providing a clear understanding of the CIC’s social mission, intended beneficiaries, activities, and commitment to community benefit. It is an opportunity to demonstrate the genuine social purpose of the CIC and its dedication to making a positive difference in the community or society it serves.

The exact content may vary based on the nature of the CIC and its intended activities, here are some elements that should typically be included in a Community Interest Statement:

- Mission and Purpose: Clearly state the primary purpose and mission of the CIC, highlighting its commitment to serving the community or addressing a specific social issue.

- Social Objectives: Outline the specific social objectives that the CIC aims to achieve. These objectives should clearly describe the positive impact the CIC intends to make on the community or society.

- Target Beneficiaries: Identify the community or target group that will benefit from the activities and services of the CIC. Describe the specific needs or challenges faced by the beneficiaries that the CIC seeks to address.

- Activities and Services: Detail the activities, programs, or services that the CIC will undertake to achieve its social objectives. Explain how these activities align with the stated social mission and how they will directly benefit the intended beneficiaries.

- Geographic Scope: Specify the geographical area or community that the CIC will primarily serve. This helps define the scope of the CIC’s impact and ensures transparency about the intended beneficiaries.

- Accountability and Governance: Describe how the CIC will ensure accountability to the community or society it serves. This may include details about the governance structure, involvement of stakeholders, and mechanisms for monitoring and reporting on social impact.

- Asset Lock: Confirm the commitment to the asset lock, which ensures that any assets or profits generated by the CIC will be used for community benefit and cannot be distributed to shareholders or individuals.

- Long-term Sustainability: Explain how the CIC plans to achieve long-term sustainability to continue delivering its social objectives and making a positive impact over time.

How to draft the asset lock for a CIC.

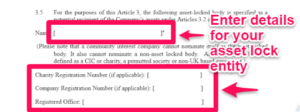

Where is this? The Asset lock forms part of the articles of association and typically appears in the definitions section towards the beginning of the model articles as shown in the following image.

The asset lock is a core feature that differentiates CICs from traditional companies and ensures that the community or social purpose remains at the forefront of the organisation’s activities.

Key aspects of the asset lock include:

Prohibition on Distribution: CICs are explicitly prohibited from distributing their assets or profits to shareholders or individuals except as allowed by law, which typically limits such distributions to situations such as asset transfers for community benefit.

Asset Transfer Restrictions: The asset lock may impose restrictions on the transfer or disposal of the CIC’s assets to ensure that any such transfers are made in accordance with the CIC’s social objectives and for the overall benefit of the community.

Reinvestment of Profits: The asset lock encourages CICs to reinvest their profits back into the organisation to further their social mission and objectives, rather than distributing profits as dividends to shareholders.

In practice you must amend the articles of association to specify another asset locked organisation to receive the assets of the CIC, or draft alternative provisions that satisfy the asset lock test in the result of dissolution of the CIC.

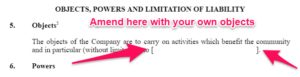

How to Draft the objects clause for a CIC

Where is this? The Objects clause forms part of the articles of association.

Clarity and Understandability: Draft the objects clause in clear and concise language that is easily understandable to a wide range of readers. Avoid technical jargon or ambiguous terms that could lead to misinterpretation.

Drafting the CIC36 : Other Considerations

Where? Use form CIC36 or add continuation sheets if necessary.

Differentiate between a company trading for profit and your CIC. Although CIC’s are able to trade for profitability in same way as any other limited company, the Registrar will often query applications on this basis. To avoid having your application delayed or rejected we recommend addressing the question head on.

If you are fundraising we recommend drafting a fundraising policy document and attaching this to your CIC 36 form to demonstrate the company knows the applicable laws and limits on fundraising.

If your CIC issues awards or bursaries (provides funding to it’s beneficiaries) we recommend drafting a policy on bursaries and awards to demonstrate to the CIC regulator that your CIC company will distribute funds in accordance with the law and in a non discriminatory manner.

Where to get Help: