When starting a new business many people choose to either register as a sole trader or start a limited company. There are many reasons for doing this. Forming a limited company offers some protection for your business name whereas sole traders business names have less protection as there is no central searchable database. Being registered means you have to file your accounts every year with Companies House showing that the company’s level of debt and that it is not insolvent. This gives them some basic guarantee that the company will be able to pay its debts.

Record numbers of limited companies have been formed in the last year. According to the latest figures from Companies House around 801,006 companies were created in 2023.

Depending on whose figures you believe there are somewhere between 1.3 million and 2.6 million companies in the UK. The Department for Business and Office for National Statistics (ONS) use the lower figure while Companies House, who keep the register of limited companies, use the higher figure. Either way companies do not make up all of the 5.6 million businesses that the government thinks there are in the UK.

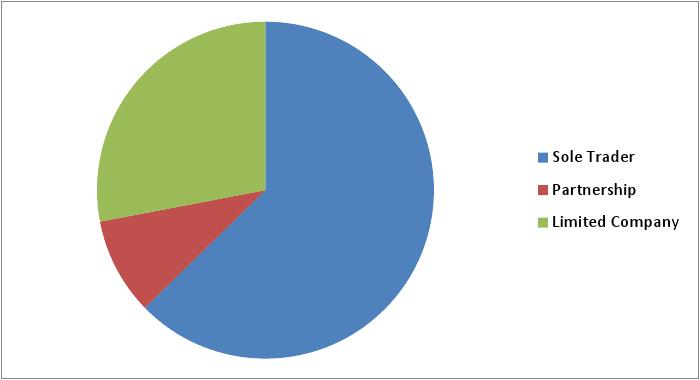

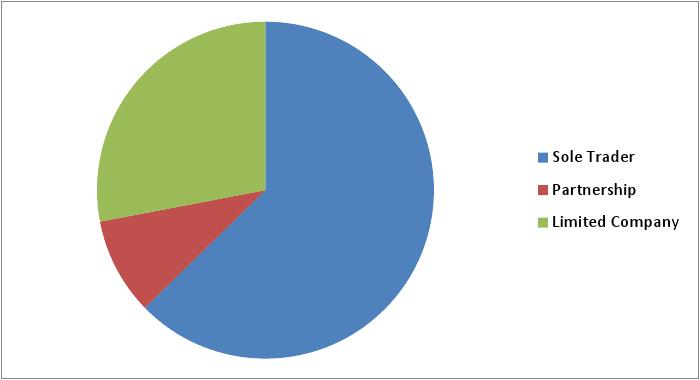

In fact the Department for Business and ONS say that limited companies only make up 37% of businesses in the UK (2.1million active companies). A further 7% are partnerships but the vast majority, 56% of UK businesses, are sole traders. It is quite hard to establish the exact number of Sole Traders as there is no central register for them. The only requirement for being a Sole Trader business is that you tell HMRC that you are self employed and HMRC do not publish the figures for the number of people who have done this. To complicate matters further being registered as self employed covers a wide range of scenarios. Someone registered as self employed could be working freelance or as a consultant. They may have a full time job and be doing some extra work in their spare time or they may be running multiple businesses. The number of sole trader businesses is therefore an educated guess.

The reason the majority of businesses choose to be sole traders is that it is a very simple way to set up and run your business. The registration with HMRC is simple to do and we can register you as a sole trader for free. Once you are registered your only duty is to complete a tax return at the end of the year. You do not have to file the accounts and returns that come with a limited company, nor will you be obligated to employ auditors or have lots of legal drafting done. There is a potential bigger risk in operating as a sole trader in that you are personally liable for any debts the business runs up but as long as you can control this risk being a sole trader is by far the simplest way to run a business.