Bleak background but opportunity knocks for micro startups.

Most businesses, the backbone of our service economy in the UK, are “micro businesses”; the “nought to niners” (0-9 employees)* and this group is what this forecast is focussed on.

I love working with this group as these are where the real people are and some of the most unique startup stories are to be found.

Here’s what I think is in store for 2023’s entrepreneurs.

The Economy

Small Business Confidence

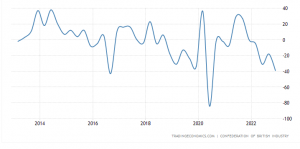

There seems little doubt that the economy will enter recession in 2023. Opinions differ on whether this is short and shallow or a longer, deeper shock. However ignoring the lockdown shock of Covid in March 2020, small business sentiment entering into 2023 is at historic low levels

Fig 1. Graph showing CBI small business confidence 10 years to Q4 December 2022.

My view is the US will be entering a recession in 2023, and that this will be longer and deeper than policy makers are currently predicting. And as we know, what happens in the US dictates how the economy will shape here.

There is a lot of concern about the fate of smaller businesses particularly in the recreation sector (pubs/cafes restaurants).

The first 2 quarters of 2023 are likely to see continued energy costs pressures that the Government, inexplicably seem to be blind too (or maybe it’s deaf as enough people appear to be telling them.

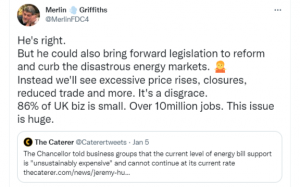

One worrying trend I’ve observed is the number of celebrities commenting on this particular issue, who do not ordinarily get involved in, or do not platform, their politics/business.

Here’s all round nice bloke Merlin Griffiths (Barman from First Dates) not pulling any punches in this tweet:

A lot of larger retail businesses have reported strong Christmas trading. However, the full effect of autumn energy price increases and continued interest rate rises is likely to squeeze “discretionary spending”.

TREND: I see the short/mid term trend for small business confidence as likely to deteriorate until later in 2023 as cost of living pressures continue to be an issue for small business both in terms of increased costs and lower spending by customers.

Unemployment

As economic conditions deteriorate, larger employers historically take the opportunity to cut their human resources and determine it is more economical to make these employees redundant rather keep them on the books until conditions improve.

I see unemployment rising as jobs are cut across the board in 2023. This trend has already been evidenced in the worryingly sharp increase in youth unemployment at the end of 2023.

Fig 2: Graph showing sharp rise in youth unemployment at end of 2022.

This impacts the micro business/startup sector in two principal ways.

Individuals are forced back into the labour market or elect to take redundancy terms offered. Some of these will again, by choice or necessity start their own businesses.

TREND: There will be a rise in people starting “lifestyle” type businesses. Leaving the corporate world behind.

These businesses can be easy to start where there is high local marketability and an underserved demand.

FINANCE

Although the bulk of the bigger rises seem to be behind us, interest rates seem set to continue to rise as central banks grapple with inflation.

There is also a tightening of the belts making it more difficult to borrow money and more expensive if you can.

The fear for banks and policy makers here is the risk of widescale defaults on lending.

This plays into the hands of micro startups who are way more likely to “bootstrap” their business.

TREND: Access to funding and the cost of borrowing seems likely to remain high and increasing certainly until at least the end of 2023.

Bootstrapping startups are likely to be on trend.

RED TAPE

Since former Prime minister David Cameron’s promise to cut red tape in 2011, and the “brexit” promise to take back control etc, Red tape (and costs) have increased for small business.

Former UK Prime Minister speaking at a small business function: Photo: Crown Copyright Photographer: Paul Shaw

2022 saw the introduction of compulsory digital VAT returns for all businesses.

Software which was never going to be free, as the government claimed, has increased rapidly over the last few years and looks set to continue to do so.

As the Government looks for ways to balance the books and squeeze as much Tax revenue as possible – There could be changes to VAT rates and “under the radar” such as a decrease in the VAT threshold could be a threat forcing smaller businesses into registration.

TREND: Increased costs associated with maintaining compliance with “Red tape” for small businesses. Possible further “red tape” snuck in under the radar by the Government in their last year before a general election.

WEALTH AND TAX

2022 has already seen changes in taxation that will squeeze the entrepreneurs of 2023. Rates have gone up and allowance cut.

From April ´23 Capital gains tax annual allowance (tax free) is cut from £12,300 to £6000.

At the same time Corporation tax on company profits increase from 19% to 25%.

However the increase does not apply smaller businesses with profits of £50,000 and under who will continue to benefit for the 19% rate.

Entrepreneurs relief lifetime allowance remained unchanged at £10 million

TREND: It’s still possible to mitigate your tax liability and “pay tax like a Tory donor”, within the rules but you will need to plan ahead and be prepared to put in some work to keep your “hard earned” in your pocket.

MARKETING/TECH

There will be opportunities for entrepreneurs able to leverage one or more of the big 3 marketing tactics.

- Dominating weak competition in businesses with high “local marketability”;

- Leveraging the power of social media platforms for lifestyle businesses with non fixed geographic;

- Identifying and building an identifiable brand within a specific niche. (This is where searchers look for your brand name in relation to the product or service you offer).

All of these tactics require an online presence in addition to the savvy use of the best in class marketing software and apps.

Personal finance reporter Jackie Annett of the Daily Express has reported some extraordinary growth projections in the micro business sector and suggests as many as 48% of Britons are considering launching a small business/side hustle this year.

TREND: Increasing spend on marketing and marketing automation by small and startups businesses. App providers offering Freemium models will outperform in the UK market in 2023.

COMPANY REGISTRATION/ SOLE TRADER STARTUPS

After a decade of increasing registrations fuelled by the lowest registration costs in the world, I believe there are a number of factors that will see this trend stall and possibly reverse in 2023.

Changes at Companies House could see the fee charged for registering a limited company increase for the first time in over 20 years. The magnitude of any rise, should it materialise, could clearly determine the impact on “vanity” registrations if the fee were to rise to a level where people need to think twice about it. The government have already recognised that the low cost of registration in the UK poses for financial crime and a report by Matt Oliver of the Telegraph (paywall) indicates proposals to increase the filing fee to £100.

Countering this trend is the impact of higher unemployment forcing people into self employment and starting their own businesses as highlighted above.

Overall I expect tightening economic conditions to unwind the phenomenon of cheap companies being held dormant on the register of companies and dissolutions will ultimately exceed registrations during 2023.

TREND: The net number of businesses starting will remain static or decrease during 2023. Incorporation costs (Government filing fees) will rise for the first time since the introduction of online company registration in 2003.

CONCLUSION

2023 looks set to be a difficult year for the economy. However, despite the backdrop, there will always be opportunities for those who are prepared to look for them.

The greatest investment you can make is in yourself (including in your own business).

Do you agree with my trends and predictions? What do you think the outlook will be for small business in 2023?

*Most of what is written about “small business” and startups is focussed on the VC funded/ unicorn /next Whatsapp / Uber/ Chat GPT.